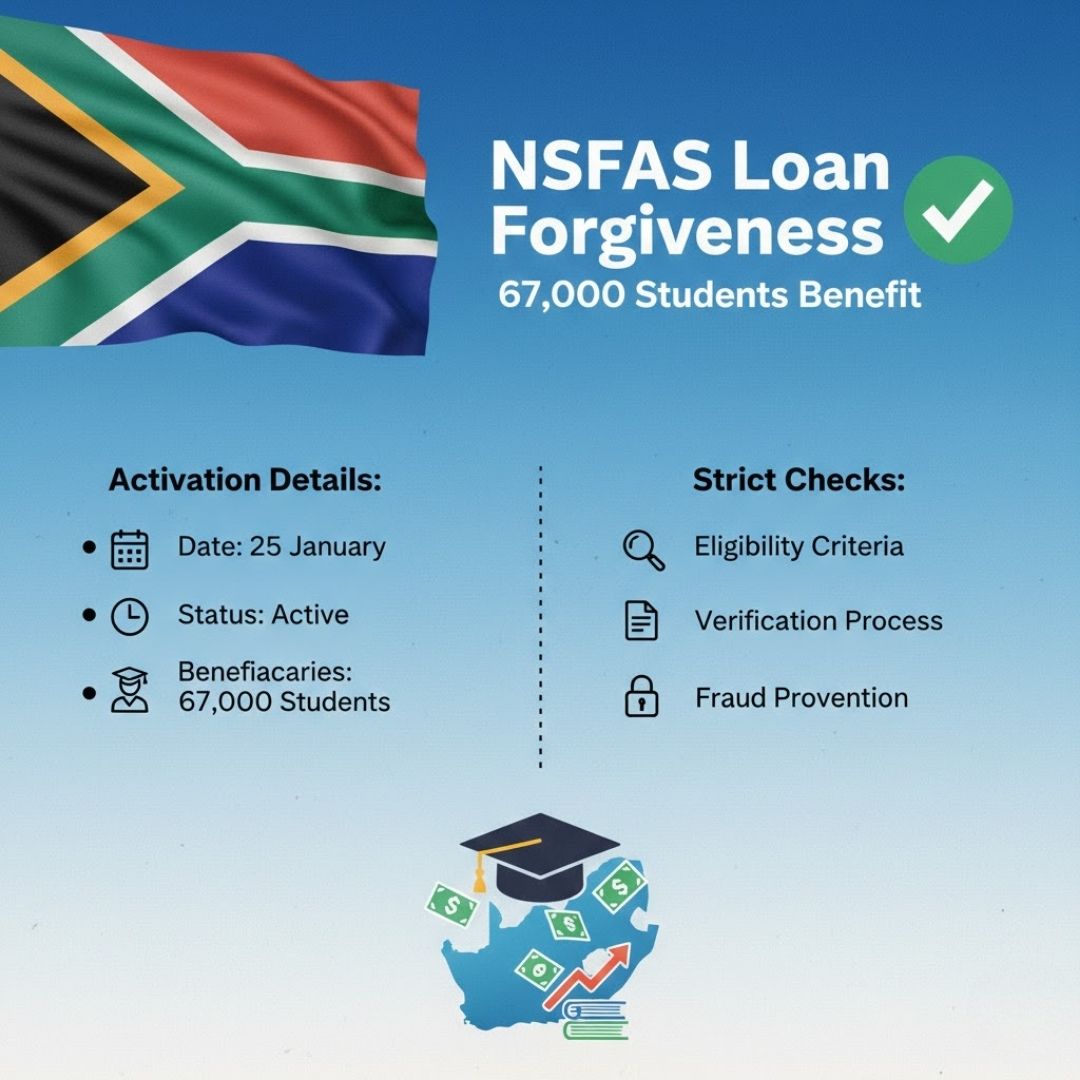

Thousands of former and current students across South Africa are set to receive long-awaited relief as the National Student Financial Aid Scheme (NSFAS) activates its loan forgiveness programme from 28 January. This major intervention will benefit around 67,000 qualifying students whose historical NSFAS loans may now be cleared, provided they meet strict eligibility and verification requirements. The move is designed to ease long-term financial pressure, support graduate mobility, and correct legacy funding challenges while ensuring public funds are responsibly managed within the country’s higher education system.

NSFAS Loan Forgiveness Rollout Begins With Careful Screening

The NSFAS loan forgiveness rollout is not automatic and comes with several safeguards to protect the integrity of the process. Only students with approved historical loans, verified academic records, and compliant institutional data will be considered. Authorities have stressed strict eligibility checks, verified enrolment records, academic progression proof, and income threshold reviews to ensure fairness. This approach aims to prioritise those who genuinely qualify while preventing misuse. For many beneficiaries, clearing old debt could mean renewed access to transcripts, improved credit standing, and better employment prospects, marking a meaningful turning point after years of repayment uncertainty.

Who Qualifies for NSFAS Loan Forgiveness in 2026

Eligibility for NSFAS loan forgiveness largely depends on when the loan was issued and the student’s academic and financial profile. The scheme mainly targets pre-2018 NSFAS loan holders who were funded before the bursary model was introduced. Applicants must meet historical loan status, institutional verification, completion confirmation, and means test limits to qualify. Students who dropped out without valid reasons or provided incomplete data may be excluded. NSFAS has encouraged potential beneficiaries to update their personal and academic information promptly to avoid delays or disqualification.

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

What Students Should Expect After NSFAS Forgiveness Activation

Once the forgiveness process is activated, approved beneficiaries should begin seeing changes reflected on their loan statements and institutional records. NSFAS has advised patience, as reconciliation across universities and colleges may take time. During this period, account balance updates, debt clearance notices, student portal alerts, and institution confirmations will be issued in phases. Students are urged to rely only on official NSFAS communication channels and avoid third-party claims. Successful clearance could unlock academic records and reduce long-term financial strain for thousands.

Why This NSFAS Loan Forgiveness Matters

This loan forgiveness initiative represents more than debt relief; it reflects a policy shift toward repairing historical funding burdens within South Africa’s higher education sector. By targeting legacy loans, NSFAS is addressing systemic issues that affected students under earlier funding models. The programme reinforces financial inclusion goals, graduate mobility support, education access reform, and long-term debt relief. While strict checks may slow the process, they also help ensure sustainability, protecting future students while offering overdue relief to those who qualify.

| Category | Requirement | Status |

|---|---|---|

| Loan Period | Pre-2018 NSFAS loans | Required |

| Academic Record | Verified by institution | Mandatory |

| Means Test | Within NSFAS threshold | Mandatory |

| Forgiveness Start | 28 January | Confirmed |

| Estimated Beneficiaries | 67,000 students | Projected |

Frequently Asked Questions (FAQs)

1. Who will benefit from NSFAS loan forgiveness?

Students with qualifying pre-2018 NSFAS loans who meet all academic and financial checks.

2. Does loan forgiveness apply automatically?

No, all accounts undergo verification before any debt is cleared.

3. When does the forgiveness process begin?

The process officially activates from 28 January.

4. Will forgiven loans reflect immediately?

Updates will appear in phases as institutions and NSFAS complete reconciliations.