The retirement age was created many years ago when people lived shorter lives and were not expected to receive income for long periods after stopping work. Today many South African citizens stay healthy and productive well into their late sixties. Economic factors like inflation and healthcare costs have made fixed retirement ages impractical for many households.

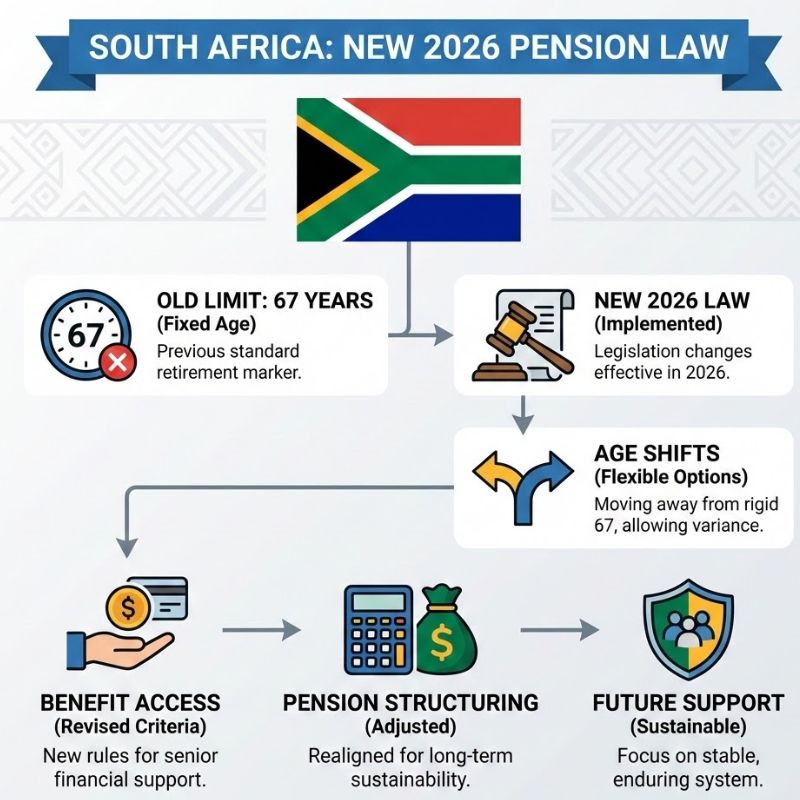

The 2026 pension legislation has moved away from strict retirement age requirements and now focuses on individual choice and decision-making. Seniors are no longer required to retire automatically at age 67 but can make their own decisions based on their health and financial situation and whether they want to keep working. These options allow older people to remain economically active according to their own preferences.

How the New Changes Reshape Elderly Benefits and Pensions

The changes continue to let older South Africans receive their pension benefits when they qualify. The reforms work to maintain senior benefits for the long term while helping people who retire after the standard age.

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

What These Updates Mean for Workers and Employers

This reform provides dignity to working people by giving them greater control over their retirement years. Workers who want to continue working no longer face automatic retirement requirements. Employers gain advantages by retaining experienced workers and preserving valuable institutional knowledge while developing positions suited to an aging workforce.

Why Smart Financial Planning Has Become Critical

Planning for Retirement at Any Age Retirement planning has become more flexible in recent years. People can now retire at different ages instead of following a fixed schedule. This shift means that future retirees need to think ahead and make deliberate choices rather than simply waiting for a predetermined retirement date. The traditional model of working until age 65 no longer applies to everyone. Some people choose to retire early while others continue working well into their seventies. This flexibility creates both opportunities and challenges for those preparing for retirement. Starting retirement planning early provides significant advantages.

Wider Social and Economic Effects Explained

The government has launched the first update in a series of reforms about aging in South Africa. Old policy statements regarding age limits and related disputed matters are no longer valid. The capacity of older workers to do their jobs and stay employed is now weighed against what they contribute to economic growth and social participation. This marks a change in how the country handles aging & work. The new system acknowledges that older employees can keep adding value to the workforce while taking part in society in meaningful ways. The updates seek to establish a more balanced method that looks at both what older workers can do and the advantages they offer to the economy & community.

A Clear Summary of What Lies Ahead

Ending Retirement at Age 67 Under 2026 Pension Laws The 2026 pension reforms bring major changes to how retirement benefits function in today’s world. These new laws allow people to end their retirement at age 67 and create more flexible choices for older adults. At the same time they help make the pension system work better over the long run. The reforms recognize that many seniors want to keep working past traditional retirement age. Some people feel healthier and more energetic than previous generations did at the same age.