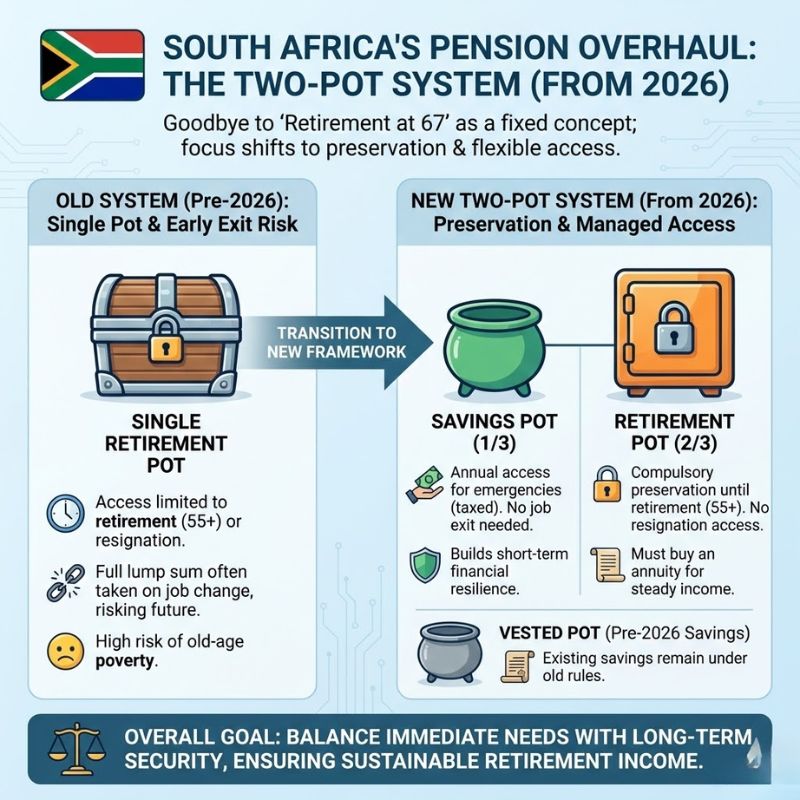

South Africa is preparing for a major shift in how people plan their working lives and retirement years. From 2026, long-standing assumptions around retiring at 67 are set to change as the government reshapes pension rules and retirement age expectations. The move reflects economic pressures, longer life expectancy, and the need to protect public pension systems for future generations. For workers, employers, and retirees alike, this overhaul signals a new phase that could redefine when people stop working and how they access pension support.

South Africa Retirement Age Reform from 2026

The proposed changes mark a decisive break from the idea that everyone must retire at a fixed age. Instead, South Africa is leaning toward a more flexible model that considers occupation, contribution history, and economic reality. Policymakers argue this approach improves financial system stability while addressing longer life expectancy among citizens. By easing pressure on state funds, the reform supports sustainable pension funding without forcing abrupt exits from the workforce. Many experts see this as a practical response to rising costs and a shifting labour market, allowing individuals to balance income needs with personal health and career goals.

Pension Framework Changes Affecting Workers

Under the new pension framework, workers may notice adjustments in contribution timelines and benefit access. Rather than a one-size-fits-all rule, the system emphasizes flexible retirement planning and encourages extended workforce participation where possible. This could particularly benefit skilled professionals who wish to remain active while still building pension value. At the same time, safeguards are being designed to protect those in physically demanding jobs. The intent is to create fair contribution rules that align payouts with actual work patterns, offering clarity and predictability for both employees and employers.

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

Impact of New Pension Rules on Retirees

For current and future retirees, the overhaul may change expectations around income security and timing. While some fear delays in access, officials highlight improved retirement income security as a core goal. By strengthening funding mechanisms, the system aims to deliver predictable pension payouts even during economic downturns. Retirees could also benefit from options that allow partial retirement, blending work and pension income. Overall, the reforms are positioned as a way to maintain dignity in later life while adapting to changing demographic trends across the country.

What This Overhaul Means Going Forward

Looking ahead, South Africa’s retirement overhaul represents a careful balancing act between fiscal responsibility and social protection. Success will depend on clear communication, gradual implementation, and trust in public institutions. If managed well, the shift could deliver long term pension resilience and encourage informed retirement decisions among citizens. However, ongoing review will be essential to ensure vulnerable groups are not left behind. For now, individuals are advised to stay informed and reassess personal plans in light of the evolving policy landscape.

| Category | Before 2026 | From 2026 |

|---|---|---|

| Standard Retirement Age | 67 years | More flexible range |

| Pension Access | Fixed age-based | Contribution-based options |

| Work After Retirement | Limited | Encouraged where suitable |

| System Goal | Age uniformity | Financial sustainability |

Frequently Asked Questions (FAQs)

1. Is retirement at 67 ending completely?

No, 67 will no longer be a strict rule, but one option among several.

2. When do the new rules start?

The updated pension and retirement framework is set to begin in 2026.

3. Will current retirees be affected?

Existing retirees are largely protected, with changes mainly for future retirees.

4. What should workers do now?

Workers should review their retirement plans and follow official updates closely.