South Africa is preparing for a major shift in how retirement is defined, as the government moves away from the long-standing norm of stopping work at 60. From 6 February 2026, revised pension age thresholds will begin reshaping expectations for workers across the country. This change reflects evolving economic realities, longer life spans, and mounting pressure on public finances. For many South Africans, the update raises practical questions about careers, savings, and long-term security, making it one of the most talked-about policy changes in recent years.

New retirement age rules reshape South Africa’s pension landscape

The decision to move beyond 60 as a fixed retirement point marks a clear new retirement age era for South Africa. Officials describe the move as a necessary policy shift aimed at balancing public spending with demographic realities. While some worry about delayed exits from work, others see opportunities for longer careers and improved savings. The adjustment will initially affect public sector workers, with private employers expected to review their own retirement policies over time. By phasing in the changes, the government hopes to reduce disruption while allowing employees to adapt gradually to the new expectations.

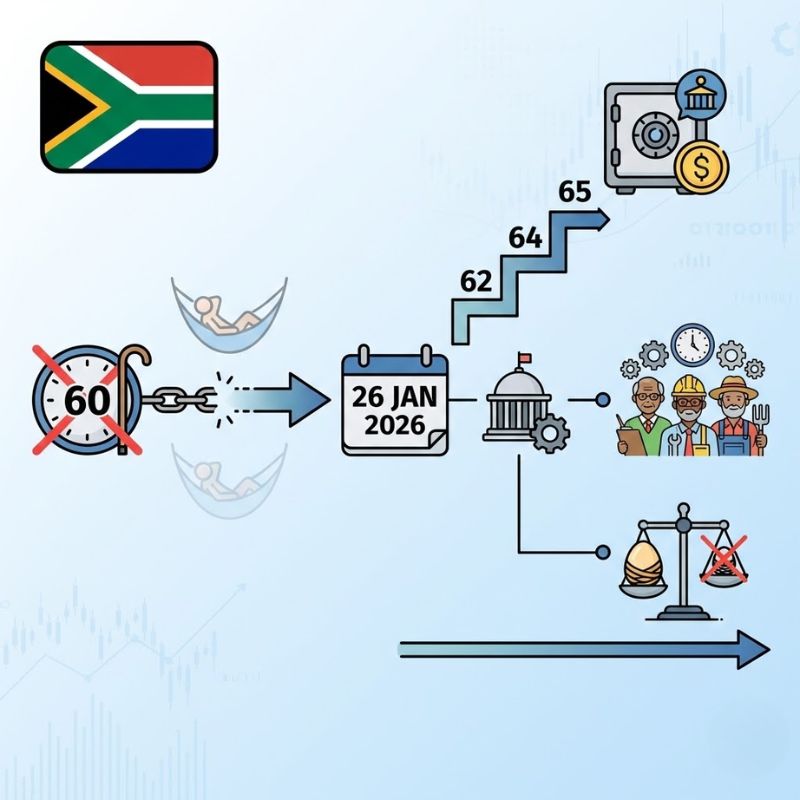

How updated pension age thresholds will be applied

Under the revised framework, pension age thresholds will vary depending on birth year and employment category, rather than applying a single cutoff. This gradual transition is designed to protect those close to retirement while giving younger workers time to plan. Authorities believe this approach supports employment stability by keeping experienced staff active for longer. For individuals, it places greater emphasis on proactive retirement planning, including reassessing savings goals and expected income timelines. Clear communication from employers and pension funds will be key to ensuring workers understand exactly where they stand.

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

Why South Africa is moving away from retirement at 60

The driving force behind the reform is financial sustainability of the national pension system. Rising life expectancy trends mean people are drawing benefits for longer, while fewer workers support the system. Increasing workforce participation among older adults is seen as one way to ease economic pressures without cutting benefits. International comparisons also show South Africa aligning with global norms, where later retirement ages are becoming standard. Together, these factors explain why policymakers believe change is unavoidable.

What the pension age change means for the future

Looking ahead, the reforms signal a rethinking of how work and aging connect in the future workforce. A stronger social security system depends on shared responsibility between the state, employers, and citizens. For individuals, the shift highlights the importance of individual choices around skills, health, and financial preparation. While the transition may feel challenging, it also opens the door to more flexible career paths and a longer period of economic contribution.

| Category | Previous Rule | New Threshold (2026) |

|---|---|---|

| Standard Retirement Age | 60 years | Variable by cohort |

| Public Sector Employees | Fixed retirement | Phased extension |

| Early Retirement Option | Limited access | Conditional access |

| Pension Payout Start | At retirement | Linked to age band |

Frequently Asked Questions (FAQs)

1. When do the new pension age rules start?

The updated thresholds take effect from 6 February 2026.

2. Does this affect private sector workers?

Private employers are not mandated but are encouraged to align their policies.

3. Can someone still retire earlier than the new age?

Early retirement may be possible under specific conditions set by pension funds.

4. Will current retirees be impacted?

No, those already retired will continue under existing pension terms.