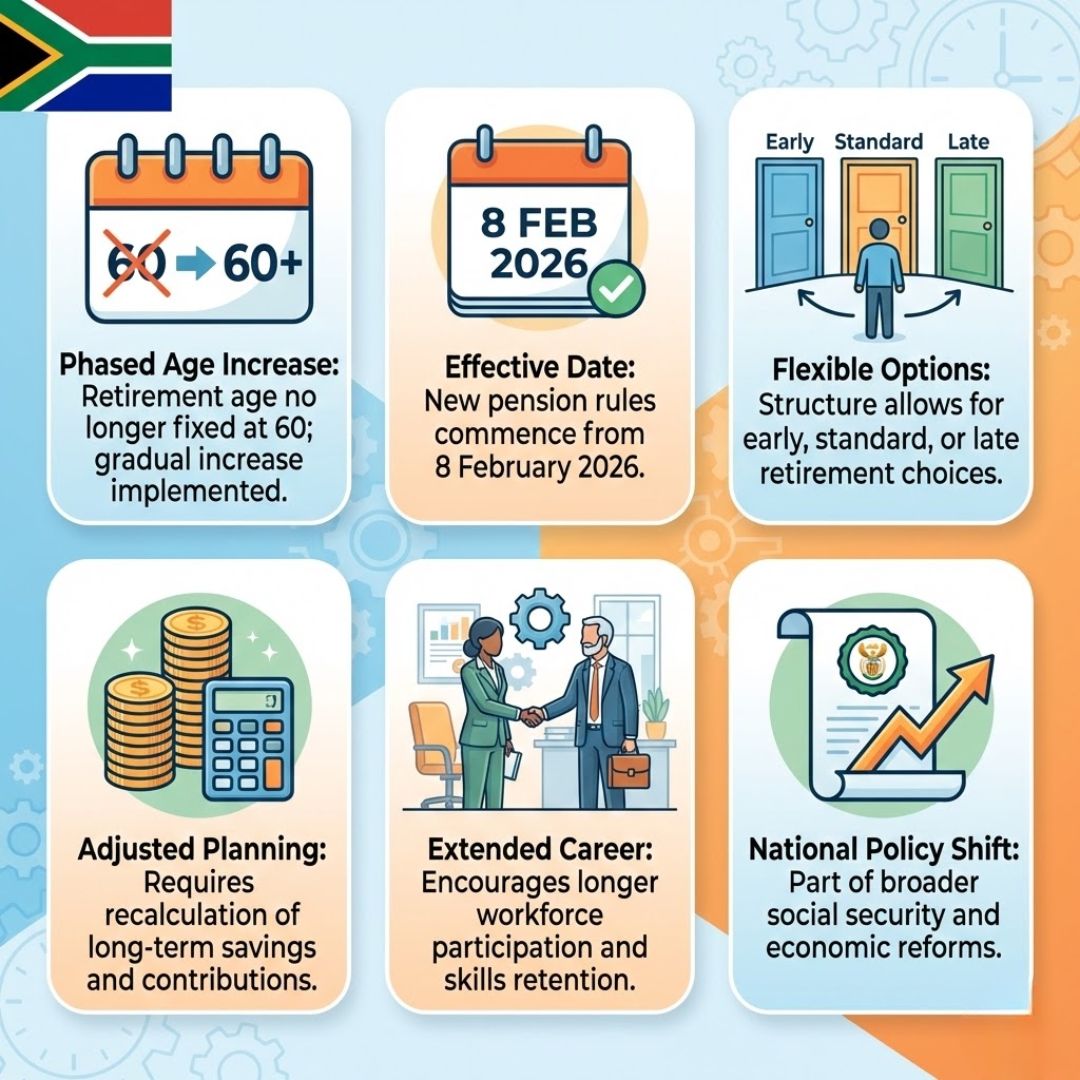

South Africa’s retirement landscape is entering a significant new phase as the long-discussed changes to the pension age structure officially take effect from 8 February 2026. For decades, many South Africans planned their working lives around the expectation of retiring at 60, shaping savings decisions, career timelines, and family responsibilities. The new framework signals a shift away from that familiar milestone, introducing updated age thresholds that reflect longer life expectancy, economic pressures, and sustainability concerns. While the adjustment may feel unsettling at first, it also opens the door to rethinking how retirement fits into modern South African life.

Retirement Age Changes in South Africa Explained

The updated retirement rules are designed to gradually move South Africa away from a fixed age of 60, replacing it with a more flexible and structured system. Instead of a single cutoff, the new model introduces adjusted age thresholds that vary depending on employment type and contribution history. Policymakers argue this helps align pensions with longer working lives and reduces strain on public funds. For many workers, the change will require career timeline reviews and updated financial planning. While some fear delayed access to benefits, others see value in extended earning years that can improve long-term security. The goal, officials say, is to create a system that balances fairness with economic reality.

How the New Pension Age Structure Affects Workers

For employees approaching retirement, the new structure introduces both challenges and opportunities. Those close to 60 may need to reassess plans based on transition age brackets outlined in the reform. Younger workers, meanwhile, gain more time to adapt their savings strategies around revised contribution periods. Employers are also expected to adjust policies to accommodate longer workforce participation, potentially reshaping hiring and promotion paths. While uncertainty remains, the change encourages earlier retirement planning and more realistic expectations about income longevity. Ultimately, the impact will differ by sector, but the emphasis is clearly shifting toward sustainability.

Why South Africa Is Moving Beyond Retirement at 60

The decision to move beyond a fixed retirement age is rooted in demographic and economic trends. South Africans are living longer, placing pressure on systems built decades ago around shorter lifespans. By introducing pension system sustainability measures, the government aims to protect future beneficiaries. Rising healthcare costs and a shrinking contributor base have also influenced policy reform drivers. Officials stress that the change is not about taking benefits away, but about ensuring long-term fund stability. In this context, retiring later becomes part of a broader strategy to maintain economic balance goals across generations.

What This Means for Retirement Planning Going Forward

As the new rules settle in, retirement planning in South Africa is likely to become more personalised and proactive. Individuals will need to factor in updated eligibility timelines and reassess when full benefits become accessible. Financial advisers are already encouraging clients to build buffers around income gap periods and consider phased retirement options. The reform may also push greater awareness of savings adequacy checks earlier in life. While change can feel disruptive, it also offers a chance to align expectations with reality, supporting more resilient retirements in the years ahead.

| Category | Previous Structure | New Structure (From Feb 2026) |

|---|---|---|

| Standard Retirement Age | 60 years | Gradual age bands |

| Eligibility Flexibility | Limited | Expanded options |

| Contribution Period | Shorter span | Extended span |

| System Sustainability | Higher strain | Improved balance |

Frequently Asked Questions (FAQs)

1. Does retirement at 60 still apply in South Africa?

No, the new rules replace a fixed age with structured retirement age bands.

Goodbye to Retirement at 67: South Africa Overhauls Pension and Retirement Age Framework from 2026

Goodbye to Retirement at 67: South Africa Overhauls Pension and Retirement Age Framework from 2026

2. When do the new pension age changes start?

The updated pension age structure takes effect from 8 February 2026.

3. Will current retirees be affected?

Those already retired are generally not impacted by the new framework.

4. How should workers prepare for the change?

Review retirement plans early and adjust savings to match the new timelines.