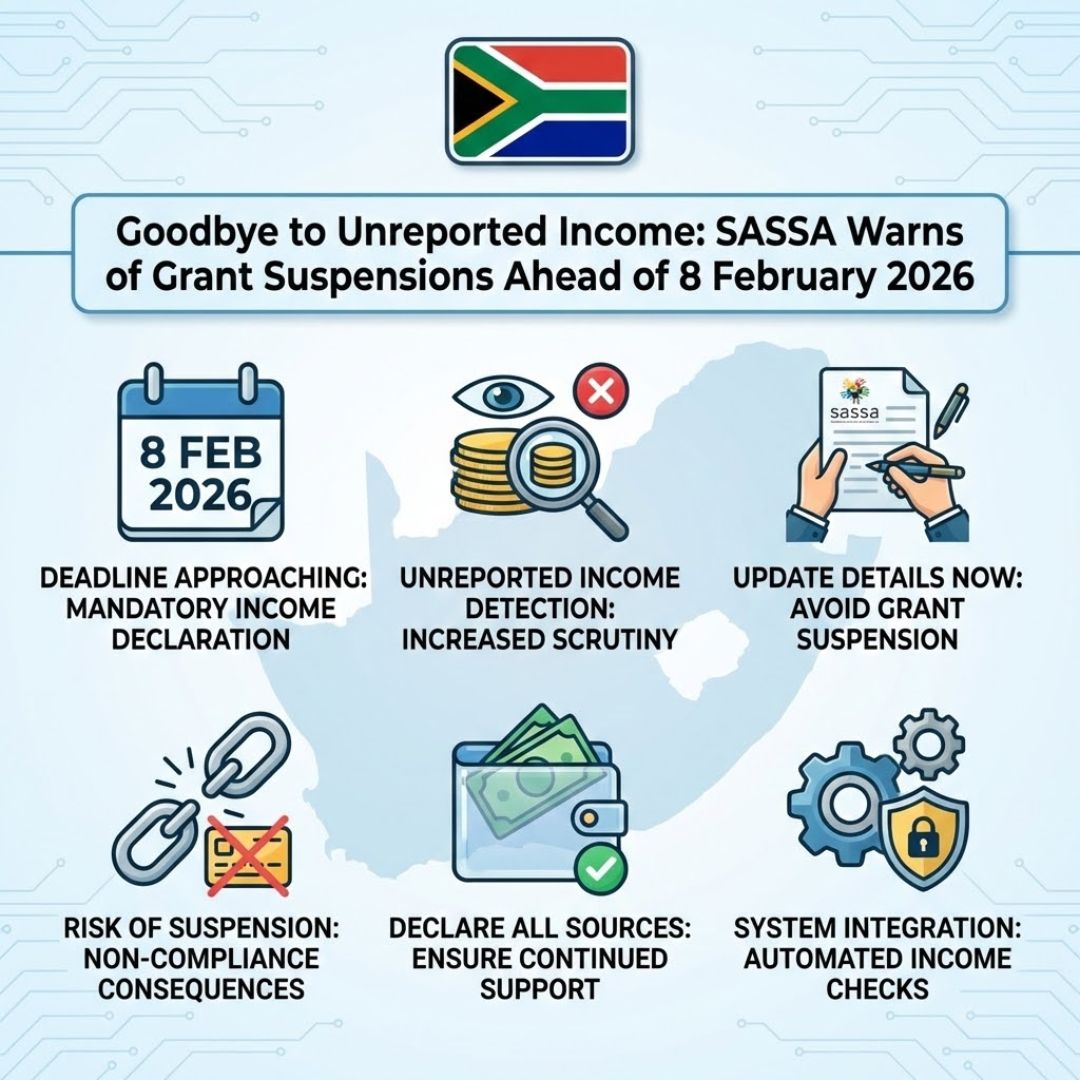

South Africa’s social assistance system is tightening its checks as the South African Social Security Agency (SASSA) issues a clear warning ahead of 8 February 2026. Beneficiaries who fail to disclose income accurately may face grant suspensions, marking a significant shift in enforcement. The move aims to protect public funds while ensuring support reaches those who truly qualify. For millions who rely on grants, understanding what counts as income, how reviews work, and what steps to take now has become more important than ever.

SASSA unreported income checks intensify before February 2026

SASSA has stepped up monitoring to identify cases where beneficiaries have failed to report additional earnings. This includes wages, informal work, or financial support received from other sources. The agency says these checks are designed to improve income transparency rules and reduce abuse across the system. Many reviews are triggered through bank account monitoring and data matching with other government departments. If discrepancies appear, beneficiaries may receive a notice requesting clarification. Ignoring these requests could lead to temporary grant suspension. The key message is simple: keeping information updated is no longer optional, especially as February 2026 approaches.

Why SASSA warns grant beneficiaries about income disclosure

The warning is not meant to scare beneficiaries but to encourage compliance. Grants are calculated based on strict means tests, and undeclared income can push recipients above the threshold. SASSA officials stress that means test limits exist to ensure fairness for all applicants. With rising demand, the agency must focus on fair grant distribution and protect funds for the most vulnerable. Beneficiaries are urged to report changes early to avoid penalties. Failing to do so may result in payment interruption risk, which can take weeks or months to resolve once a suspension is applied.

Grant suspensions linked to unreported income explained

If SASSA determines that income was deliberately hidden, the consequences can be serious. Suspensions may be followed by reviews or even cancellations in extreme cases. However, honest mistakes are usually handled differently, especially when beneficiaries respond promptly. The agency encourages proactive updates through official channels to prevent compliance review process issues. Keeping records and proof of earnings helps during assessments. Importantly, SASSA says beneficiary responsibility reminder applies to all grant types equally. Acting early can prevent long-term payment loss and reduce stress during the review period.

What this means for beneficiaries moving forward

As February 2026 draws closer, beneficiaries should see this warning as an opportunity rather than a threat. Reviewing personal finances, checking eligibility, and updating details can help maintain uninterrupted support. SASSA’s approach signals a stronger focus on accountability while still offering room for correction. Clear communication and cooperation can protect access to grants and avoid unnecessary hardship. Ultimately, the goal is a system that balances support with responsibility, ensuring public resources remain available for those who need them most in South Africa.

| Item | Details | Impact on Grant |

|---|---|---|

| Unreported wages | Income from formal or informal work | Possible suspension |

| Bank interest | Earnings from savings accounts | Review required |

| Family support | Regular financial assistance | Eligibility reassessed |

| Data review date | Before 8 February 2026 | Enforcement begins |

Frequently Asked Questions (FAQs)

1. What counts as unreported income?

Any regular or once-off money received that was not declared to SASSA.

2. Will my grant stop immediately?

Usually no, as SASSA often issues a notice before suspending payments.

3. How can I update my income details?

You can update information through official SASSA offices or approved channels.

4. Does this apply to all grants?

Yes, all grant types are subject to income disclosure rules.