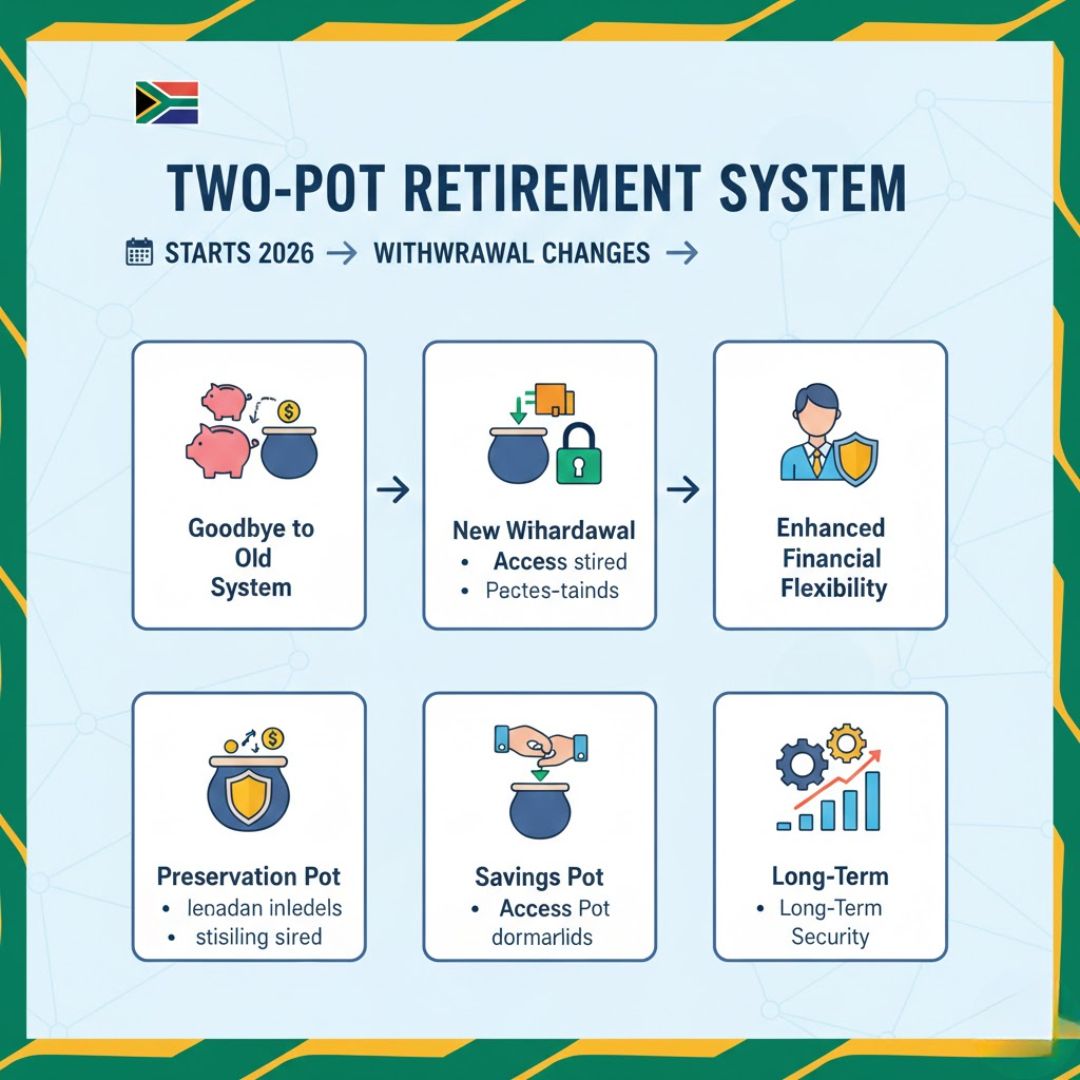

A major change is coming to South Africa’s retirement system by 2026 with the introduction of the Two-Pot Retirement System. This new system aims to balance long-term retirement security with short-term financial flexibility. The main goal is to protect workers’ retirement savings for their future while also allowing limited access to some benefits when needed. The system creates a middle ground between two important needs. On one side it safeguards retirement funds so workers have money when they stop working. On the other side it recognizes that people sometimes need access to their savings before retirement. This approach tries to serve both purposes without compromising either one too much. The Two-Pot system represents a practical solution to a common problem many workers face. They want their retirement money protected and growing for the future but they also want some ability to use those funds during financial emergencies. The new framework addresses both concerns by dividing retirement savings into separate portions with different access rules

What You Need to Know About the Two-Pot Retirement System

The retirement contributions in this scheme will be split into two parts. One part will be locked until retirement and cannot be taken out before reaching the official retirement age. The second part works as a savings component that includes protections to prevent workers from withdrawing all their retirement money when they change jobs. This system makes sure that people will have financial security when they retire.

The Reasons Behind the Introduction of the System

Workers need to know how to access their retirement fund and understand the tax rules for withdrawals. Financial experts suggest that people should only use this money during genuine emergencies. The smartest strategy is to keep retirement savings intact and work toward creating a stable financial foundation for the future. If done properly the Two-Pot Retirement System might represent a significant step forward in retirement planning for South Africans.

Goodbye to Lower Super Contributions: Updated Contribution Rates Take Effect February 2026

Goodbye to Lower Super Contributions: Updated Contribution Rates Take Effect February 2026

How This Will Impact Wage Earners and Employers

In exchange for better financial discipline the two-pot system lets workers access some of their own money during emergencies while encouraging them to plan for retirement over the long term. Payroll systems & fund structures will adapt to these new rules as employers and retirement fund administrators work to maintain transparency & careful management.

Goodbye to 65: South Africa Redraws Retirement Rules in 2026 and Millions Must Recheck Plans

Goodbye to 65: South Africa Redraws Retirement Rules in 2026 and Millions Must Recheck Plans

How to Prepare for the Upcoming 2026 Changes

Workers should understand how their retirement fund can be distributed and how their payments will be taxed. Financial experts recommend that people learn to leave their retirement money untouched except during serious emergencies rather than constantly accessing it. This approach helps ensure a comfortable & secure retirement. When implemented correctly the Two-Pot Retirement System could mark the beginning of a new era for retirement planning in South Africa.