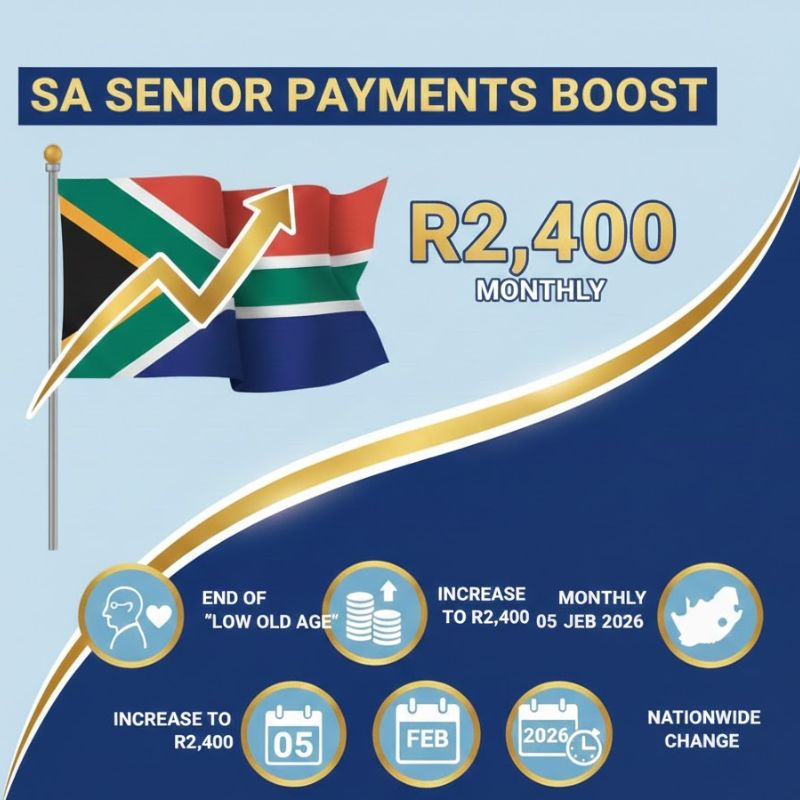

South Africa’s senior citizens are set to receive welcome financial relief as the Old Age Pension increases to R2,400 per month starting 5 February 2026. This long-anticipated adjustment reflects rising living costs, ongoing inflation pressures, and growing concerns around elderly poverty. Administered by SASSA, the updated pension aims to better support older South Africans who rely heavily on monthly grants for essentials like food, utilities, and healthcare. For many households, this change represents more than just extra money—it signals renewed government focus on dignity, stability, and improved quality of life for retirees nationwide.

Old Age Pension Increase Brings Financial Relief

The move to raise the Old Age Pension to R2,400 marks a significant shift in how senior support is structured in South Africa. With food prices, transport costs, and electricity tariffs climbing, many pensioners have struggled to stretch previous payments. This increase directly targets monthly cost pressures, offering breathing room for essentials while reducing dependence on family support. Officials say the adjustment considers inflation-linked planning and aims to restore basic purchasing power. For seniors living alone, the boost can mean improved daily living stability and better access to essential household needs.

SASSA Payment Update Starting February 2026

SASSA has confirmed that the new R2,400 pension amount will be paid automatically from 5 February 2026, with no reapplication required for existing beneficiaries. Payments will continue through standard channels, including bank deposits, retail outlets, and designated pay points. The agency emphasizes automatic grant adjustment to avoid confusion or delays. Seniors are encouraged to keep personal details updated to ensure smooth payment processing. This rollout is part of a broader system-wide grant upgrade aimed at improving reliability, reducing errors, and maintaining on-time monthly deposits across all regions.

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

Who Benefits Most From the Higher Senior Grant

The pension increase is especially impactful for low-income seniors with limited or no additional retirement savings. Many recipients rely solely on grants for survival, making this change critical for income-dependent households. Older citizens facing high medical expenses may also see benefits through better healthcare affordability. Rural pensioners, often affected by higher transport costs, gain added support for basic mobility needs. Overall, the adjustment strengthens elderly financial security and helps narrow gaps created by long-term economic pressures.

Summary and Impact Analysis

The February 2026 Old Age Pension increase reflects a practical response to South Africa’s changing economic realities. While R2,400 may not eliminate financial hardship entirely, it does offer measurable relief for millions of seniors. The move supports social welfare sustainability while reinforcing the state’s responsibility toward aging citizens. Over time, this adjustment could reduce reliance on emergency aid and family assistance. If paired with future reviews, the increase may contribute to long-term pension adequacy and improved retirement quality outcomes.

| Category | Details |

|---|---|

| Grant Type | Old Age Pension |

| Previous Amount | Below R2,400 |

| New Monthly Amount | R2,400 |

| Start Date | 5 February 2026 |

| Administering Body | SASSA |

Frequently Asked Questions (FAQs)

1. When does the new R2,400 pension start?

The increased Old Age Pension begins from 5 February 2026.

2. Do seniors need to reapply for the increase?

No, existing beneficiaries will receive the higher amount automatically.

3. How will the pension be paid?

Payments will continue via bank accounts, retailers, and SASSA pay points.

4. Who qualifies for the Old Age Pension?

South African citizens or permanent residents meeting age and means-test criteria qualify.