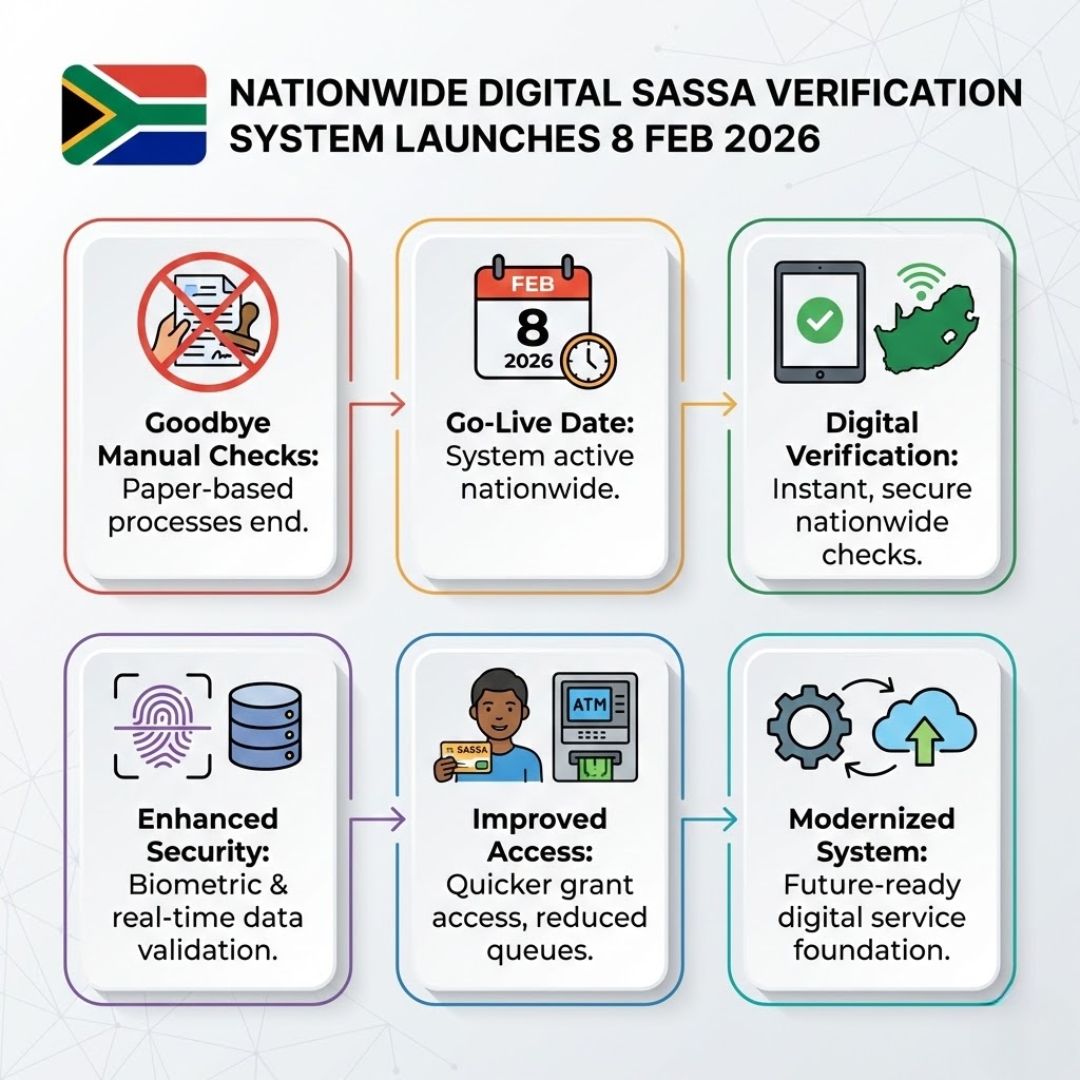

From long queues to repeated paperwork, manual grant checks have been a familiar frustration for millions of beneficiaries. Starting 8 February 2026, South Africa is taking a major step forward with the launch of a nationwide digital verification system for SASSA. This new approach aims to replace outdated manual checks with faster, technology-driven processes that link identity, banking, and eligibility data in real time. For beneficiaries across the country, the change signals a shift toward greater accuracy, reduced delays, and a more streamlined experience when accessing social grants.

Digital SASSA Verification Replaces Manual Checks

The new system officially marks the end of manual verification methods that relied heavily on in-person visits and paper records. By integrating digital platforms, SASSA can now verify beneficiary details through secure databases, reducing errors and duplication. This move introduces real-time validation, ensures identity-linked records, and improves payment accuracy. Beneficiaries will notice fewer interruptions, as the system flags issues early rather than stopping payments unexpectedly. The change also supports fraud reduction by cross-checking data across departments, creating a more reliable and transparent grant administration process nationwide.

Nationwide Digital System for SASSA Beneficiaries

Rolling out across all provinces, the digital verification system is designed to work uniformly, whether a beneficiary lives in a major city or a rural area. It connects with Home Affairs and banking partners to confirm eligibility automatically. This ensures faster approvals, promotes consistent checks, and reduces the need for repeated document submissions. Importantly, SASSA has emphasized data security to protect personal information while improving service delivery. For many, this nationwide approach means fewer trips to offices and a smoother interaction with the grant system.

Goodbye to Retirement at 67: South Africa Overhauls Pension and Retirement Age Framework from 2026

Goodbye to Retirement at 67: South Africa Overhauls Pension and Retirement Age Framework from 2026

SASSA Digital Verification Launch Impact

The launch from 8 February 2026 is expected to reshape how beneficiaries interact with SASSA services. Instead of reacting to sudden suspensions, recipients will benefit from early issue detection and clearer communication. The system supports automatic status updates, helping beneficiaries stay informed without constant checking. Over time, this could lead to reduced queues at offices and more efficient use of staff resources. While adjustments may be needed initially, the long-term goal is a more responsive and dependable grant verification process.

What This Change Means Going Forward

Beyond convenience, the digital verification system reflects a broader shift toward modern public services. It aligns social assistance with current technology standards, offering long-term efficiency and system transparency. Beneficiaries gain confidence knowing their details are checked consistently, while SASSA benefits from better oversight and planning capabilities. As the system matures, it may also open doors to future digital services, reinforcing trust between citizens and the state through a more reliable social support framework.

| Feature | Manual System | Digital Verification System |

|---|---|---|

| Verification Method | Paper-based checks | Automated data matching |

| Processing Time | Several days or weeks | Near real-time |

| Error Detection | After payment issues | Before payment runs |

| Office Visits | Frequent | Minimal |

Frequently Asked Questions (FAQs)

1. When does the digital verification system start?

The nationwide system officially launches on 8 February 2026.

2. Do beneficiaries need to reapply for grants?

No, existing grants continue while verification happens digitally.

3. Will payments be delayed during the transition?

SASSA expects payments to continue normally with fewer disruptions.

4. Is personal data safe in the new system?

Yes, the system uses secure integrations to protect beneficiary information.