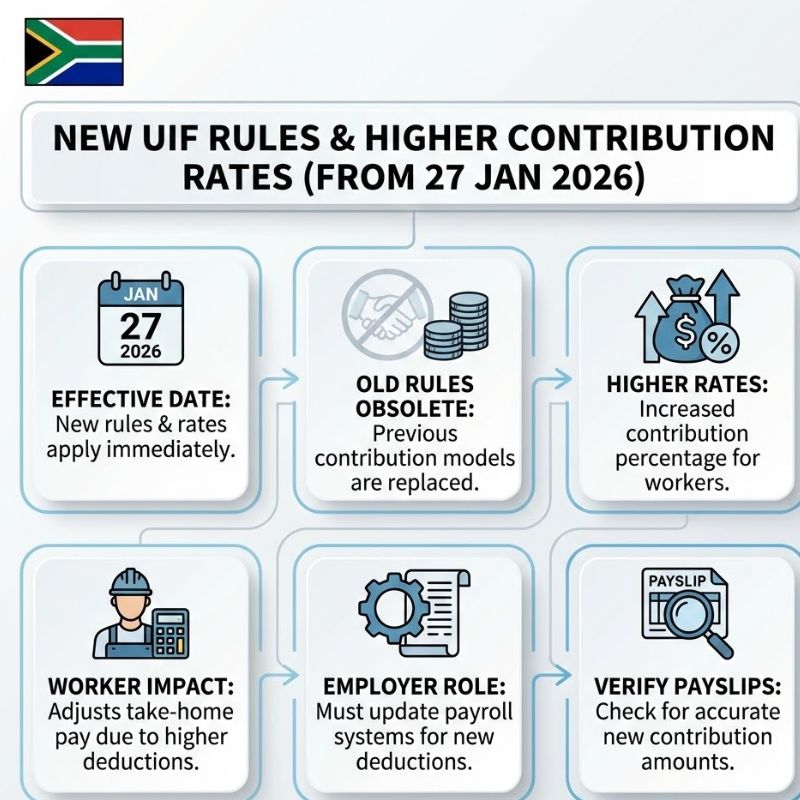

South Africa’s employment sector is preparing for significant changes as the Unemployment Insurance Fund introduces higher contribution rates starting 27 January 2026. Workers and employers have become accustomed to the existing payroll deductions over many years. However increasing demands on benefit payments and necessary policy updates are changing how the UIF receives its funding. These adjustments are designed to improve income protection for people who lose their jobs while keeping the system financially stable for the long term. With the implementation date getting closer employees in all industries are reviewing their payslips. Meanwhile businesses are updating their payroll systems to meet the new requirements that will apply across the country.

UIF Contribution Rate Adjustments Reshape Payroll Deductions

From late January 2026, employees will start noticing changes in how UIF contributions appear on their payslips. The revised rules introduce higher contribution rates, which directly affect monthly take-home pay, even if the difference seems minimal at first. For many households, the increase in payroll deductions may call for modest budgeting adjustments, particularly for those already managing rising transport and food costs. Employers, at the same time, must account for the employee cost impact while ensuring payroll systems calculate deductions correctly. While the objective focuses on long-term worker protection, the immediate effect is that employer adjustments become unavoidable as payroll software, contracts, and internal policies are updated to comply with the new legal requirements.

How Updated UIF Rules Impact Employees and Businesses

The revised structure goes beyond simply increasing contribution percentages; it also refines how earning limits are applied. Authorities have aligned deductions with an updated contribution cap, meaning higher earners may experience changes that were previously softened by thresholds. This adjustment introduces a clearer monthly UIF ceiling linked directly to wages, reducing uncertainty for payroll teams. Under the new model, a wage-based calculation formula guides deductions, making compliance easier to verify but harder to overlook. Businesses that fail to meet compliance deadlines could face penalties, prompting many employers to prioritise early preparation.

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

Getting Ready for UIF Contribution Increases in 2026

Early preparation can help reduce the impact of the January changes. Employees are encouraged to review payslips regularly, paying close attention to payslip verification to ensure deductions align with official guidelines. Employers should focus on completing HR and payroll system updates well ahead of the deadline to avoid last-minute issues. On a personal level, advance budget planning can help households adjust to slightly lower net income with less disruption. If discrepancies occur, knowing the dispute resolution process and monitoring official notices can prevent prolonged problems and ensure contributions are accurately recorded.

What the UIF Rule Changes Signal for the Future

Looking forward, the UIF revisions point to a broader shift in worker protection across South Africa. Although higher deductions may feel challenging in the short term, policymakers describe the move as part of a wider effort to strengthen social safety nets. By reinforcing the fund, authorities aim to sustain benefits during economic downturns and periods of job transition, keeping an income protection focus intact. For employers, clearer and more predictable rules support planning, while workers gain reassurance that their contributions translate into meaningful support. Over time, these measures are intended to promote long-term stability without restricting employment growth.

| Aspect | Old UIF Rules | New UIF Rules (From Jan 2026) |

|---|---|---|

| Contribution Level | Lower, familiar rates | Higher adjusted rates |

| Earnings Threshold | Previous capped limit | Revised contribution cap |

| Payroll Processing | Existing systems | Updated payroll calculations |

| Compliance Risk | Minimal if unchanged | Penalties for non-compliance |