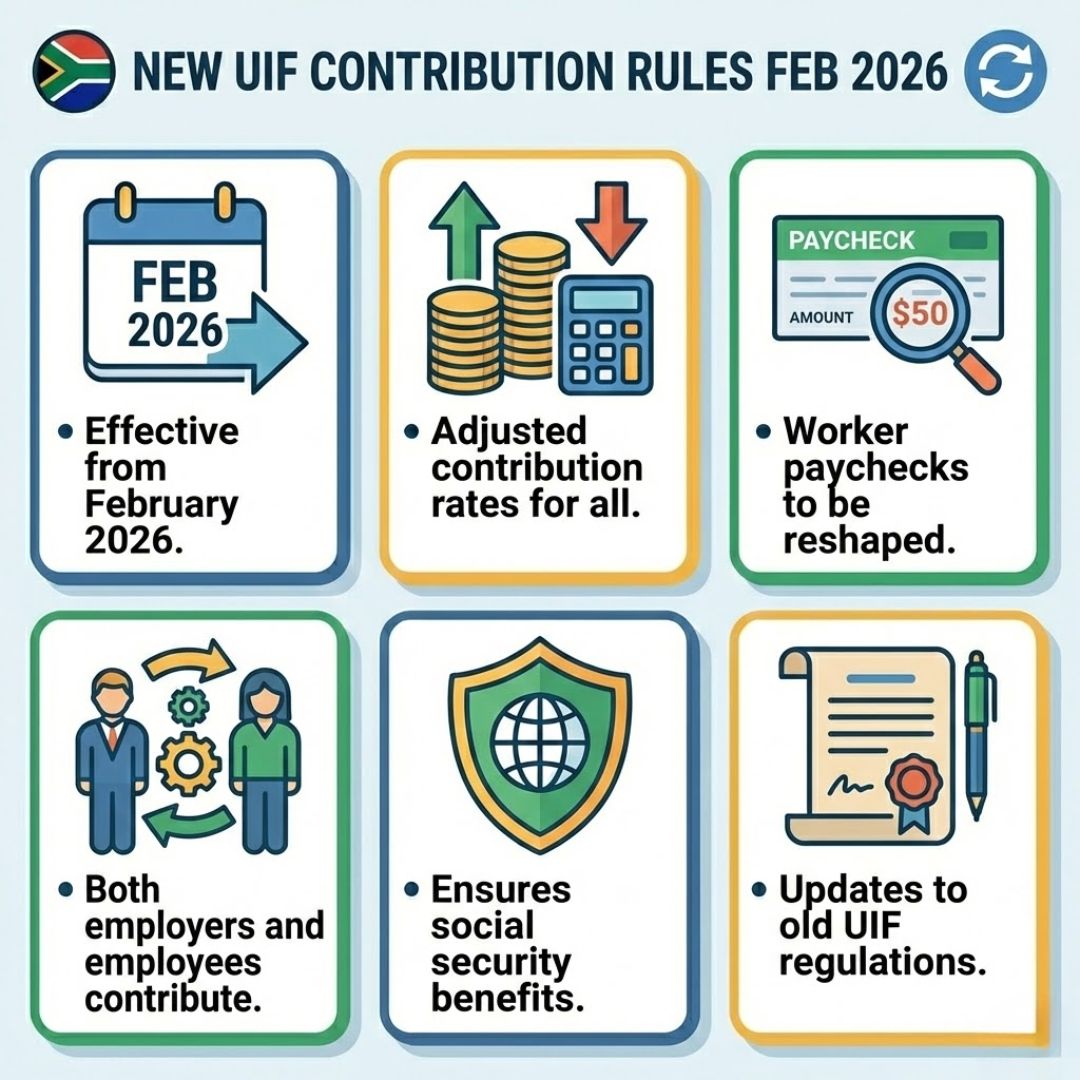

South Africa is preparing for a notable shift in how employee protections are funded, as long-standing Unemployment Insurance Fund (UIF) rules are set to change from February 2026. The update focuses on contribution structures that directly affect worker paychecks and employer payroll systems. While UIF has always played a quiet but essential role in income security, these adjustments signal a broader effort to modernise funding and keep pace with changing wage patterns. For employees and businesses alike, understanding what is changing — and why — will be key to avoiding surprises once the new rules take effect.

What the New UIF Rules Mean for Workers

The introduction of the new UIF rules marks a shift in how contributions are calculated and applied across salary bands. One of the most discussed elements is the contribution ceiling shift, which may alter how much is deducted from monthly earnings, particularly for formally employed workers. Although UIF deductions have always been modest, these refinements could subtly influence monthly deductions visible on payslips. For many employees, the change will not feel dramatic, but it reflects broader payroll adjustments aimed at strengthening the fund’s long-term capacity while keeping contributions aligned with modern income levels.

UIF Contribution Rate Changes and Paychecks

From February 2026, updated rules will guide how employee contributions and employer matching portions are applied within the UIF system. While the contribution concept remains familiar, changes in thresholds could mean that higher earners see slightly different deductions than before. For lower- and middle-income workers, the impact on take-home pay is expected to be minimal, but the revised structure aims to distribute funding more evenly. Overall, the goal is to maintain fairness while ensuring the UIF remains adequately funded to support workers during periods of unemployment or reduced income.

SRD Approved but No Payment Date: Steps beneficiaries should take and common reasons for delays

SRD Approved but No Payment Date: Steps beneficiaries should take and common reasons for delays

How Employers Must Prepare for UIF Updates

Employers will need to pay close attention to the UIF changes to meet the compliance deadline set for February 2026. Payroll systems must be reviewed to ensure accuracy and pay slip clarity for staff. Many businesses are already seeking HR guidance to interpret how the updated rules apply to different contract types and salary levels. Beyond policy awareness, practical system updates will be essential to avoid errors that could result in penalties or employee dissatisfaction once the new UIF framework is fully implemented.

Why These UIF Changes Matter Long Term

At a broader level, the UIF update represents a careful policy transition rather than a sudden overhaul. By adjusting contribution mechanics now, South Africa is positioning the fund for better resilience amid changing labour patterns. For workers, this supports more reliable coverage and encourages proactive financial planning. For employers, clarity and consistency help maintain workforce stability. Ultimately, the focus is on benefit sustainability, ensuring the UIF remains a dependable safety net without placing unnecessary strain on salaries or business operations.

| Aspect | Before 2026 | From Feb 2026 |

|---|---|---|

| Contribution basis | Fixed earnings ceiling | Adjusted earnings threshold |

| Employee deduction | Standard rate | Rate within new limits |

| Employer portion | Matching contribution | Aligned with updates |

| Payslip impact | Stable deductions | Slight variation possible |

Frequently Asked Questions (FAQs)

1. When do the new UIF rules start?

The updated UIF contribution rules take effect from February 2026.

NSFAS Allowance Update: R5,200 late payment reasons status checks and what students must do now

NSFAS Allowance Update: R5,200 late payment reasons status checks and what students must do now

2. Will all workers pay more UIF?

No, most workers will see minimal change, with adjustments mainly affecting higher salary brackets.

3. Do employers need to take action?

Yes, employers must update payroll systems to comply with the new UIF requirements.

4. Does UIF coverage change with the new rules?

The coverage remains the same, but funding sustainability is strengthened.