The South African Social Security Agency has confirmed a significant pension increase for 2026 that will benefit millions of elderly citizens throughout the country. The approved increase of R1050 aims to help senior citizens cope with rising costs for essential needs including food & groceries as well as transportation and medical care and household utilities. This adjustment reflects the government’s continued commitment to protecting vulnerable populations and ensuring financial stability for pensioners. The increase comes at a critical time when inflation has placed considerable pressure on household budgets. Many pensioners rely entirely on their monthly grants to cover basic living expenses.

Why the 2026 Pension Increase Truly Matters

Rising inflation & higher living costs have created serious financial pressure for people who depend on fixed incomes. Many seniors rely on their monthly pension as their main or only way to pay for necessities. The R1050 increase is designed to help restore some of the purchasing power they have lost and reduce their financial stress. This adjustment supports beneficiaries in maintaining their dignity and independence as they age.

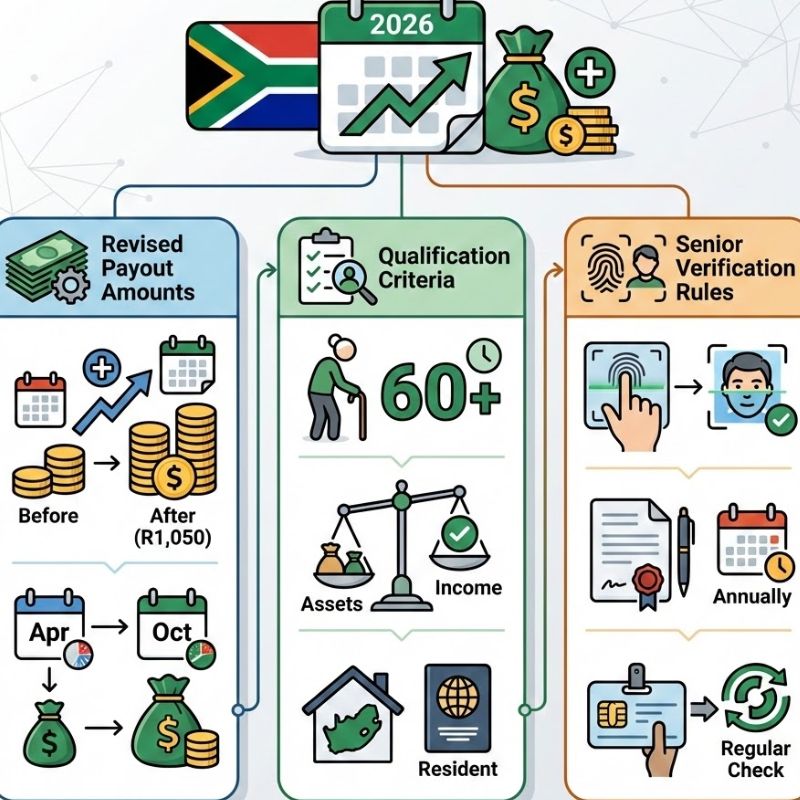

Who Qualifies for the Increased Pension Amount

The higher payment goes to old age grant recipients who qualify under SASSA’s current age requirements along with income and asset limits. Seniors already getting the pension will receive the increase automatically if their personal information and eligibility status stay the same. Current beneficiaries do not need to reapply.

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

SASSA February 2026 Payment Update: R560 and R1,250 Grants Move on 5 February With Key Reminders

How Monthly Pension Payments Will Be Delivered Reliably

SASSA has confirmed that pension payments will continue normally throughout 2026 without any interruptions. The new payment amount will be added to the standard monthly schedule to ensure beneficiaries receive steady & reliable income. Seniors who use bank accounts or retail pay points or grant cards will get the higher pension through the same payment method they currently use.

Key Actions Pensioners Must Take to Avoid Delays

Although payments remain secure seniors should ensure their personal information stays current. Keeping valid identification and accurate banking details on file helps prevent delays or temporary holds on payments. Pensioners who haven’t recently confirmed their information may receive requests for routine verification checks.

How Older South Africans Benefit Beyond Payments

The pension increase does more than just provide money to older people. It helps them stay healthier and eat better food while improving their quality of life. When elderly citizens receive more pension money they can take care of themselves without depending as much on their children or other family members. This means younger family members have less financial stress because they don’t need to spend as much of their own income supporting their aging relatives with basic expenses like food and medicine.