South Africa’s older citizens are set to see meaningful financial relief as changes to the Old Age Pension take effect in early 2026. With the government confirming higher monthly support, many seniors will move away from the long-criticised low pension amounts that struggled to keep up with daily costs. From 12 February 2026, eligible beneficiaries can expect increased monthly payments that aim to improve dignity, stability, and independence in later life. This update reflects broader efforts to support vulnerable households while addressing rising living expenses across the country.

Old Age Pension Increase Brings Relief

The Old Age Pension increase marks a significant shift for seniors who rely on monthly grants as their main source of income. For years, pensioners have voiced concerns about rising household costs, basic needs pressure, and limited savings options in retirement. The updated payment level is designed to better reflect modern expenses, including food, utilities, and transport. While it may not solve every financial challenge, the increase offers more breathing room and helps reduce stress linked to unpredictable monthly spending. Many seniors see this as a step toward a more realistic support system that acknowledges the true cost of living in South Africa today.

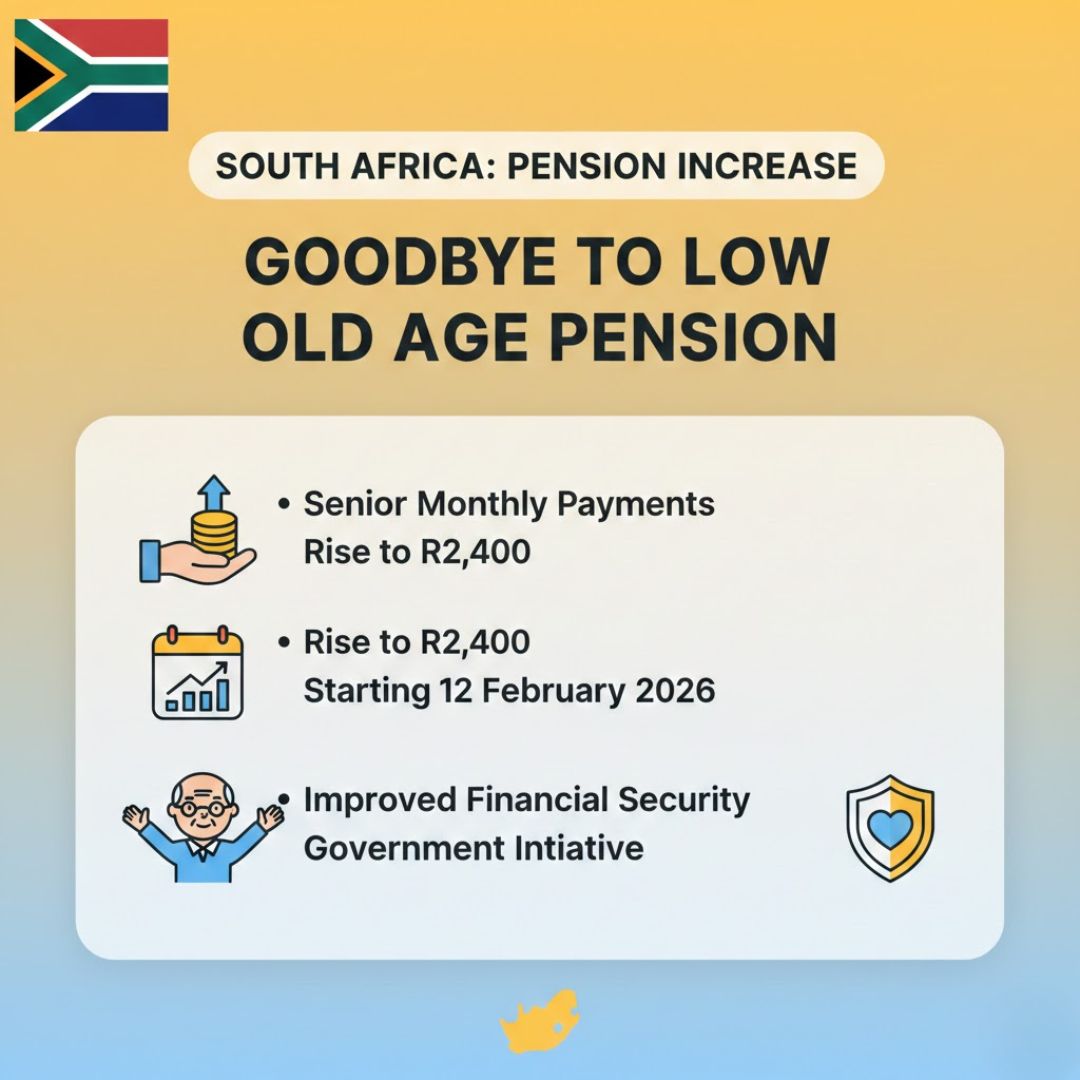

Senior Monthly Payments Set at R2,400

Under the new arrangement, senior monthly payments will rise to R2,400, creating a more dependable income base for eligible recipients. This change responds to inflation-driven strain, everyday expense growth, and fixed income limits that have affected pensioners nationwide. The higher amount is expected to help cover essentials more comfortably, reducing the need for debt or family assistance. For many older adults, predictable and slightly higher payments translate into better planning and fewer financial emergencies. It also reinforces the idea that social support should evolve alongside economic realities rather than remain static.

February 2026 Pension Changes Explained

The February 2026 pension changes officially begin on 12 February, giving beneficiaries a clear timeline to expect the updated amount. Authorities have highlighted payment date clarity, administrative readiness, and beneficiary assurance as priorities to ensure a smooth rollout. Seniors are encouraged to verify their details to avoid delays, though no reapplication is required for those already approved. This update signals a broader commitment to maintaining consistency and trust in the social grant system, helping older citizens feel secure about their monthly income going forward.

What This Pension Update Means

Overall, the pension update represents more than just a numerical increase; it reflects a shift in how senior welfare is viewed. By addressing long-term affordability concerns, retirement income stability, social support confidence, and policy responsiveness, the change aims to strengthen financial resilience among older adults. While challenges remain, especially as prices continue to rise, this adjustment provides a foundation for better quality of life. For many seniors, the increase brings reassurance that their needs are being acknowledged within national planning.

| Category | Details |

|---|---|

| Country | South Africa |

| New Monthly Amount | R2,400 |

| Start Date | 12 February 2026 |

| Eligible Group | Approved Old Age Pensioners |

| Payment Frequency | Monthly |

Frequently Asked Questions (FAQs)

1. When does the new pension amount start?

The increased Old Age Pension begins from 12 February 2026.

2. What is the new monthly payment amount?

Eligible seniors will receive R2,400 per month.

3. Do current pensioners need to reapply?

No, existing approved beneficiaries do not need to reapply.

4. Who qualifies for the increased pension?

All seniors who meet the Old Age Pension eligibility criteria qualify.